Warren Buffett's Letters to Berkshire Shareholders 1978

BERKSHIRE HATHAWAY INC.

波克夏海瑟崴股份有限公司

To the Shareholders of Berkshire Hathaway Inc.:

致Berkshire公司全體股東:

First, a few words about accounting. The merger with Diversified Retailing Company, Inc. at yearend adds two new complications in the presentation of our financial results. After the merger, our ownership of Blue Chip Stamps increased to approximately 58% and, therefore, the accounts of that company must be fully consolidated in the Balance Sheet and Statement of Earnings presentation of Berkshire. In previous reports, our share of the net earnings only of Blue Chip had been included as a single item on Berkshire’s Statement of Earnings, and there had been a similar one-line inclusion on our Balance Sheet of our share of their net assets.

首先,是會計相關的議題,在年底與多元零售公司的合併後,對於公司的財務報表有兩項影響,首先在合併案完成後,我們對藍籌郵票的持股比例將提高至58%左右,意味著該公司的資產負債以及盈餘數字必須全部納到Berkshire的報表之內,在此之前,我們僅透過權益法按投資比例認列藍籌郵票的淨值與收益。

This full consolidation of sales, expenses, receivables, inventories, debt, etc. produces an aggregation of figures from many diverse businesses - textiles, insurance, candy, newspapers, trading stamps - with dramatically different economic characteristics. In some of these your ownership is 100% but, in those businesses which are owned by Blue Chip but fully consolidated, your ownership as a Berkshire shareholder is only 58%. (Ownership by others of the balance of these businesses is accounted for by the large minority interest item on the liability side of the Balance Sheet.) Such a grouping of Balance Sheet and Earnings items - some wholly owned, some partly owned - tends to obscure economic reality more than illuminate it. In fact, it represents a form of presentation that we never prepare for internal use during the year and which is of no value to us in any management activities.

如此全面性地將營收、費用、應收帳款、存貨及負債等科目合併,所產生的數字將來自於各種產業特性截然不同的行業,包含紡織、保險、糖果、報紙及郵票等,某些行業各位的持有的權益是100%,某些例如由藍籌郵票所持有的卻只有58%(至於其他股東所代表的權益,則列在資產負債表右半邊負債科目的少數股東權益項下),對於財務報表這樣的歸類,我們認為非但無法解釋實際現況反而模糊了真正的焦點,事實上,我們內部從來就不使用這樣的報表進行分析管理。

For that reason, throughout the report we provide much separate financial information and commentary on the various segments of the business to help you evaluate Berkshire’s performance and prospects. Much of this segmented information is mandated by SEC disclosure rules and covered in “Management’s Discussion” on pages 29 to 34. And in this letter we try to present to you a view of our various operating entities from the same perspective that we view them managerially.

基於這樣的理由,在接下來的報告中,我們將針對個別的行業提供各自的財務數字及分析檢討,以協助各位評估Berkshire實際的表現及前景,這些資訊大都是證管會資訊揭露的相關要求,詳見29頁到34頁的管理階層討論,至於在這裡我們則試著以經營者的角度為各位分析各個營利單位的表現。

A second complication arising from the merger is that the 1977 figures shown in this report are different from the 1977 figures shown in the report we mailed to you last year. Accounting convention requires that when two entities such as Diversified and Berkshire are merged, all financial data subsequently must be presented as if the companies had been merged at the time they were formed rather than just recently. So the enclosed financial statements, in effect, pretend that in 1977 (and earlier years) the Diversified-Berkshire merger already had taken place, even though the actual merger date was December 30, 1978. This shifting base makes comparative commentary confusing and, from time to time in our narrative report, we will talk of figures and performance for Berkshire shareholders as historically reported to you rather than as restated after the Diversified merger.

合併案所引發的第二項影響則是今年報表中秀出1977年的數字與去年提供給各位同一年度的數字有所不同,會計原則要求當像多元零售與Berkshire這樣二個獨立個體合併時,所有報告的財務數字都必須假設這兩家公司原本就在一起,所以後續呈現所有數字,是假設這兩家公司早在1977年(甚至更早以前)就已經合併,雖然真正合併的日期是1978年的12月30日,這樣的改變使得比較性的評論很容易產生混淆,因為以往的報告中,我們告訴各位的都是Berkshire的歷史記錄,而非依照合併多元零售後重新修正數字。

With that preamble it can be stated that, with or without restated figures, 1978 was a good year. Operating earnings, exclusive of capital gains, at 19.4% of beginning shareholders’ investment were within a fraction of our 1972 record. While we believe it is improper to include capital gains or losses in evaluating the performance of a single year, they are an important component of the longer term record. Because of such gains, Berkshire’s long-term growth in equity per share has been greater than would be indicated by compounding the returns from operating earnings that we have reported annually.

然而即便在這樣的前提下,我們還是可以如此說,不論財報數字是否重編,1978年都是豐收的一年,不含資本利得的營業利益約為期初股東投資成本的19.4%,雖然低於1972年的歷史記錄,我們認為評估單一年度的表現,不適宜將資本利得或損失納入計算,但不可否認他們卻是衡量長期績效的重要指標,拜這類利得所賜,Berkshire每股權益長期的成長率遠大於每年年度營業利益所帶來的複利報酬。

For example, over the last three years - generally a bonanza period for the insurance industry, our largest profit producer - Berkshire’s per share net worth virtually has doubled, thereby compounding at about 25% annually through a combination of good operating earnings and fairly substantial capital gains. Neither this 25% equity gain from all sources nor the 19.4% equity gain from operating earnings in 1978 is sustainable. The insurance cycle has turned downward in 1979, and it is almost certain that operating earnings measured by return on equity will fall this year. However, operating earnings measured in dollars are likely to increase on the much larger shareholders’ equity now employed in the business.

舉例來說,過去三年算是保險業的黃金歲月,這行業也是Berkshire獲利主要來源,拜其所賜我們的每股淨值呈倍數成長,每年的營業利益與資本利得約當以25%的速度增加,但我們不認為25%的股東權益年成長或19.4%營業利益的年成長可以維持多久,保險業的景氣循環已於1979年開始反轉向下,所以今年的營業利益相較於股東權益的比率很有可能會下滑,當然營業利益的金額還是會繼續增加。

In contrast to this cautious view about near term return from operations, we are optimistic about prospects for long term return from major equity investments held by our insurance companies. We make no attempt to predict how security markets will behave; successfully forecasting short term stock price movements is something we think neither we nor anyone else can do. In the longer run, however, we feel that many of our major equity holdings are going to be worth considerably more money than we paid, and that investment gains will add significantly to the operating returns of the insurance group.

相較於對短期營運的保守看法,我們對於目前保險子公司所持有的股票投資卻感到相當樂觀,我們從來不會想要去預測股票市場的走勢,事實上,我不認為包含我自己本身在內,有人能夠「成功」地預測股市短期間的波動,然而就長期而言,我們覺得我們這些主要持股的價值終將遠超過我們當初投資的成本,而這些投資收益將會使得保險事業的盈餘表現更上一層樓。

Sources of Earnings

盈餘報告

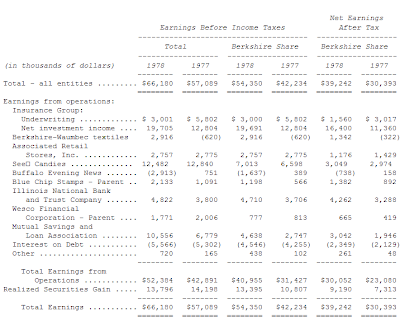

To give you a better picture of just where Berkshire’s earnings are produced, we show below a table which requires a little explanation. Berkshire owns close to 58% of Blue Chip which, in addition to 100% ownership of several businesses, owns 80% of Wesco Financial Corporation. Thus, Berkshire’s equity in Wesco’s earnings is about 46%. In aggregate, businesses that we control have about 7,000 full-time employees and generate revenues of over $500 million.

為了讓各位對Berkshire的盈餘來源有所了解,讓我稍微解釋一下下面這張表,Berkshire約持有藍籌郵票58%的股權,而後者除了持有一些企業100%的股權外,還另外擁有Wesco金融公司80%的股權,也因此Berkshire等於間接持有Wesco約46%的股權,總的來說,我們旗下事業約有7,000名全職的員工,年營收達到5億美元。

The table shows the overall earnings of each major operating category on a pre-tax basis (several of the businesses have low tax rates because of significant amounts of tax-exempt interest and dividend income), as well as the share of those earnings belonging to Berkshire both on a pre-tax and after-tax basis. Significant capital gains or losses attributable to any of the businesses are not shown in the operating earnings figure, but are aggregated on the “Realized Securities Gain” line at the bottom of the table. Because of various accounting and tax intricacies, the figures in the table should not be treated as holy writ, but rather viewed as close approximations of the 1977 and 1978 earnings contributions of our constituent businesses.

下表顯示各個主要營運單位的稅前盈餘(有幾家公司適用的稅率較低主要的原因是免稅的利息及股息收入),以下是Berkshire按持股比例可分得的稅前及稅後盈餘,各事業的資本利得或損失則不包含在營業利益之內,而是加總列在已實現證券利得項下,由於複雜的會計及稅務規定,大家不必將這些數字看得很神聖,最好是單純地把他們當作是旗下事業在1977年及1978年對於母公司所貢獻的盈餘。

Blue Chip and Wesco are public companies with reporting requirements of their own. Later in this report we are reproducing the narrative reports of the principal executives of both companies, describing their 1978 operations. Some of the figures they utilize will not match to the penny the ones we use in this report, again because of accounting and tax complexities. But their comments should be helpful to you in understanding the underlying economic characteristics of these important partly-owned businesses. A copy of the full annual report of either company will be mailed to any shareholder of Berkshire upon request to Mr. Robert H. Bird for Blue Chips Stamps, 5801 South Eastern Avenue, Los Angeles, California 90040, or to Mrs. Bette Deckard for Wesco Financial Corporation, 315 East Colorado Boulevard, Pasadena, California 91109.

藍籌郵票及Wesco都是公開發行公司,各自都必須對外公開報告,在年報的後段附有這兩家公司主要經理人關於公司1978年現況的書面報告,他們運用的部份數字可能無法與我們的報告絲毫不差,這又是因為會計與稅務一些細節規定所致,但我認為他們的見解將有助於各位了解這些旗下重要事業的經營現況,若有需要Berkshire的股東可向Mr. Robert(地址:加州洛杉磯5801 South Eastern Avenue)索取藍籌郵票的年報或向Mrs. Bette(地址:加州Pasadena 315 East Colorado Boulevard)索取Wesco的年報。

Textiles

紡織業

Earnings of $1.3 million in 1978, while much improved from 1977, still represent a low return on the $17 million of capital employed in this business. Textile plant and equipment are on the books for a very small fraction of what it would cost to replace such equipment today. And, despite the age of the equipment, much of it is functionally similar to new equipment being installed by the industry. But despite this “bargain cost” of fixed assets, capital turnover is relatively low reflecting required high investment levels in receivables and inventory compared to sales. Slow capital turnover, coupled with low profit margins on sales, inevitably produces inadequate returns on capital. Obvious approaches to improved profit margins involve differentiation of product, lowered manufacturing costs through more efficient equipment or better utilization of people, redirection toward fabrics enjoying stronger market trends, etc. Our management is diligent in pursuing such objectives. The problem, of course, is that our competitors are just as diligently doing the same thing.

1978年的盈餘達到130萬美元,較1977年有所改進,但相較於投入的1,700萬資本來說,報酬率還是很低,目前紡織廠房及設備帳列的價值遠低於未來重置所需的成本,雖然這些設備都已相當老舊,但大部分的功能與目前同業所採用的全新設備差異並不大,但盡管固定資產的投入不須太大,但銷售所須負擔的應收帳款及存貨週轉資金卻是相當沈重的擔子,紡織業低資產週轉率與低毛利無可避免地造成低落的股東權益報酬率,可能的改善方式包括產品差異化、使用新設備降低製造成本或妥善運用人力、朝高附加價值的紡織品轉型等,我們的管理階層正致力達到以上目標,當然真正的問題在於這也正是我們的競爭同業正在努力做的。

The textile industry illustrates in textbook style how producers of relatively undifferentiated goods in capital intensive businesses must earn inadequate returns except under conditions of tight supply or real shortage. As long as excess productive capacity exists, prices tend to reflect direct operating costs rather than capital employed. Such a supply-excess condition appears likely to prevail most of the time in the textile industry, and our expectations are for profits of relatively modest amounts in relation to capital.

紡織業的現況充分地說明了教科書中提到的,當資本密集但產品無重大差異化的生產者註定將賺取微薄的報酬,除非供給吃緊或真正短缺,只要市場產能過剩,產品價格就會隨直接營運成本而非投入資金作變動,不幸的是這樣的情況正是目前紡織業的常態,所以我們只能期望獲取稍微合理的投資報酬即可。

We hope we don’t get into too many more businesses with such tough economic characteristics. But, as we have stated before: (1) our textile businesses are very important employers in their communities, (2) management has been straightforward in reporting on problems and energetic in attacking them, (3) labor has been cooperative and understanding in facing our common problems, and (4) the business should average modest cash returns relative to investment. As long as these conditions prevail - and we expect that they will - we intend to continue to support our textile business despite more attractive alternative uses for capital.

我們希望以後不要再介入這類產業面臨困境的企業,但就像之前曾經提到的,只要(1) 該公司為當地非常重要的雇主(2)管理當局坦誠面對困境並努力解決問題(3)勞工體認現況並極力配合(4)相對於投入的資金,尚能產生穩定現金收入。只要以上前提存在,我們也相信一定會,我們就會繼續支持紡織事業的營運,雖然這樣將使得我們被迫放棄其他更有利的資金運用管道。

Insurance Underwriting

保險核保業務

The number one contributor to Berkshire’s overall excellent results in 1978 was the segment of National Indemnity Company’s insurance operation run by Phil Liesche. On about $90 million of earned premiums, an underwriting profit of approximately $11 million was realized, a truly extraordinary achievement even against the background of excellent industry conditions. Under Phil’s leadership, with outstanding assistance by Roland Miller in Underwriting and Bill Lyons in Claims, this segment of National Indemnity (including National Fire and Marine Insurance Company, which operates as a running mate) had one of its best years in a long history of performances which, in aggregate, far outshine those of the industry. Present successes reflect credit not only upon present managers, but equally upon the business talents of Jack Ringwalt, founder of National Indemnity, whose operating philosophy remains etched upon the company.

1978年Berkshire盈餘貢獻的第一功臣當屬由Phil Liesche所帶領的國家產險公司,在所賺取的9,000萬美元保費收入當中,有1,100萬美元是已實現的核保利益,即便是產業情況不錯的環境下仍屬相當難得,在Phil的領導以及Roland Miller核保部門與Bill Lyons理賠部門的襄助之下,國家產險(包含國家火海險公司)創下有史以來表現最佳的一年,其表現更遠優於其他同業,如今的成功不僅反應出現任經營者的功勞,還要歸功於國家產險創辦人Jack Ringwalt的遠見,其經營哲學目前仍深深烙印在公司之上。

Home and Automobile Insurance Company had its best year since John Seward stepped in and straightened things out in 1975. Its results are combined in this report with those of Phil Liesche’s operation under the insurance category entitled “Specialized Auto and General Liability”.

去年是家庭汽車保險公司自1975年John Seward介入並改正公司營運以來表現最佳的一年,其成績連同Phil的營運績效一起被放在特殊汽車及一般責任險業務範圍之內。

Worker’s Compensation was a mixed bag in 1978. In its first year as a subsidiary, Cypress Insurance Company, managed by Milt Thornton, turned in outstanding results. The worker’s compensation line can cause large underwriting losses when rapid inflation interacts with changing social concepts, but Milt has a cautious and highly professional staff to cope with these problems. His performance in 1978 has reinforced our very good feelings about this purchase.

1978年勞工退休保險是一個混合體,在她被列為Milt Thornton管理的Cypress保險公司子公司的第一年便繳出漂亮的成績單,勞工退休保險業務在通貨膨脹加劇以及社會觀念改變的情況下,有可能產生鉅額的核保損失,但Milt擁有一組謹慎且極度專業的團隊小心處理這些問題, 1978年他的表現使我們對於買進這項業務開始有不錯的感覺。

Frank DeNardo came with us in the spring of 1978 to straighten out National Indemnity’s California Worker’s Compensation business which, up to that point, had been a disaster. Frank has the experience and intellect needed to correct the major problems of the Los Angeles office. Our volume in this department now is running only about 25% of what it was eighteen months ago, and early indications are that Frank is making good progress.

Frank DeNardo是在1978年春天加入我們改正國家產險在加州勞工退休保險業務的行列,當時這項業務可以說是一場災難,Frank具有導正加州辦公室問題所需的經驗與智慧,目前這個部門的業務量只有一年半前的四分之一,初步的結果顯示Frank已有相當好的開始。

George Young’s reinsurance department continues to produce very large sums for investment relative to premium volume, and thus gives us reasonably satisfactory overall results. However, underwriting results still are not what they should be and can be. It is very easy to fool yourself regarding underwriting results in reinsurance (particularly in casualty lines involving long delays in settlement), and we believe this situation prevails with many of our competitors. Unfortunately, self-delusion in company reserving almost always leads to inadequate industry rate levels. If major factors in the market don’t know their true costs, the competitive “fall-out” hits all - even those with adequate cost knowledge. George is quite willing to reduce volume significantly, if needed, to achieve satisfactory underwriting, and we have a great deal of confidence in the long term soundness of this business under his direction.

George Young的再保險部門創造的保費收入持續挹注投資所需的大量資金,並繳出相當令人滿意的成績單,只是核保部門的績效依舊不如預期理想,再保險的核保成績很容易讓人搞錯(尤其是理賠時間通常拉得很長的意外險業務),而我們相信其他同業普遍也面臨這樣的問題,不幸的是,公司損失準備提列的自我迷惑通常導致不當的保險費率結構,如果市場上的主要份子對於自身的成本結構不甚了解,那麼競爭爆炸的結果是傷到所有的參與者,也包含那些具有成本意識的業者在內,如果有必要的話,為達到合理的核保績效,George寧願捨棄大部分的業務,而我們也有信心就長期而言,這項業務在他的領導之下會有不錯的表現。

The homestate operation was disappointing in 1978. Our unsatisfactory underwriting, even though partially explained by an unusual incidence of Midwestern storms, is particularly worrisome against the backdrop of very favorable industry results in the conventional lines written by our homestate group. We have confidence in John Ringwalt’s ability to correct this situation. The bright spot in the group was the performance of Kansas Fire and Casualty in its first full year of business. Under Floyd Taylor, this subsidiary got off to a truly remarkable start. Of course, it takes at least several years to evaluate underwriting results, but the early signs are encouraging and Floyd’s operation achieved the best loss ratio among the homestate companies in 1978.

Homestate 1978年的營運讓人感到相當失望,雖然核保績效差,部份的原因要歸咎於中西部意外發生的風暴,但是一向表現優異的傳統保單業務惡化的情況卻特別令人感到憂心,我們對於John Ringwalt導正這種情況的能力有信心,堪薩斯火險第一個完整會計年度不錯的表現讓我們吃下一棵定心丸,在Floyd Taylor的領導下,這個分支單位有一個非常好的開始,當然至少要好幾年才能評估其真正的核保績效,但初步的結果令人感到相當振奮,而Floyd 1978年的損失比率也是Homestate所有單位中表現最佳的。

Although some segments were disappointing, overall our insurance operation had an excellent year. But of course we should expect a good year when the industry is flying high, as in 1978. It is a virtual certainty that in 1979 the combined ratio (see definition on page 31) for the industry will move up at least a few points, perhaps enough to throw the industry as a whole into an underwriting loss position. For example, in the auto lines - by far the most important area for the industry and for us - CPI figures indicate rates overall were only 3% higher in January 1979 than a year ago. But the items that make up loss costs - auto repair and medical care costs - were up over 9%. How different than yearend 1976 when rates had advanced over 22% in the preceding twelve months, but costs were up 8%.

雖然某些單位的績效令人感到失望,但總的來說,我們保險事業還是渡過了豐收的一年,當然就像1978年一樣,在整個產業預期相對樂觀的情況下,我們還是期待來年的豐收,幾乎可以肯定的是1979年整個產業的綜合比率(定義請參閱第31頁)將會上揚幾個百分點,甚至有可能使得整個產業平均面臨核保損失的情況,比如以目前產險業中最重要的車險業務來說,1979年一月顯示消費者物價指數僅比去年同期增加3個百分點,但是損失成本-包含修理及醫療費用的支出卻上揚的9個百分點,這與1976年物價指數上揚22百分點但相關成本僅增加8個百分點的情況,有很大的不同。

Margins will remain steady only if rates rise as fast as costs. This assuredly will not be the case in 1979, and conditions probably will worsen in 1980. Our present thinking is that our underwriting performance relative to the industry will improve somewhat in 1979, but every other insurance management probably views its relative prospects with similar optimism - someone is going to be disappointed. Even if we do improve relative to others, we may well have a higher combined ratio and lower underwriting profits in 1979 than we achieved last year.

只有當費率增加的幅度與成本上揚的速度一致時,才得以維持穩定的利潤空間,但很顯然1979年的情況並非如此,而1980年甚至有可能還會繼續惡化,我們現在的想法是我們1979年的核保績效應該會比同業好一點,但其他保險同業或許也抱持著跟我們相同的看法,所以可以肯定的是其他一定有人會失望,而就算我們比其他同業表現要好一點,我們的綜合比率還是有可能進一步提高,使得我們1979年的核保利益就去年衰退。

We continue to look for ways to expand our insurance operation. But your reaction to this intent should not be unrestrained joy. Some of our expansion efforts - largely initiated by your Chairman have been lackluster, others have been expensive failures. We entered the business in 1967 through purchase of the segment which Phil Liesche now manages, and it still remains, by a large margin, the best portion of our insurance business. It is not easy to buy a good insurance business, but our experience has been that it is easier to buy one than create one. However, we will continue to try both approaches, since the rewards for success in this field can be exceptional.

另外一方面,我們還是不斷尋求增加保險業務的機會,不過各位對於我們這樣的企圖千萬不要一面倒地感到高興,我們一些擴張的努力,大部分都是由我本人所發起的,事後證明都是半調子,有的還付出昂貴的代價,事實上,經由買進Phil Liesche的業務,我們在1967年進入保險事業,而到目前為止,這個部門還是我們所有保險事業中表現最好的,實在是很難買到一家好的保險公司,但要創立一家更難,然而我們還是會不斷地用各種方法,因為一旦成功所獲得的回報是相當驚人的。

Insurance Investments

保險事業的投資

We confess considerable optimism regarding our insurance equity investments. Of course, our enthusiasm for stocks is not unconditional. Under some circumstances, common stock investments by insurers make very little sense.

我們必須承認對於保險事業的股票投資有點過於樂觀,當然我們對於股票的偏愛並非毫無限制,在某些情況下,保險公司投資股票一點意義都沒有。

We get excited enough to commit a big percentage of insurance company net worth to equities only when we find (1) businesses we can understand, (2) with favorable long-term prospects, (3) operated by honest and competent people, and (4) priced very attractively. We usually can identify a small number of potential investments meeting requirements (1), (2) and (3), but (4) often prevents action. For example, in 1971 our total common stock position at Berkshire’s insurance subsidiaries amounted to only $10.7 million at cost, and $11.7 million at market. There were equities of identifiably excellent companies available - but very few at interesting prices. (An irresistible footnote: in 1971, pension fund managers invested a record 122% of net funds available in equities - at full prices they couldn’t buy enough of them. In 1974, after the bottom had fallen out, they committed a then record low of 21% to stocks.)

只有當以下條件都符合時,我們才會想要將保險公司大部分的資金投入到股票投資之上:(1)我們可以了解的行業(2)具有長期競爭力(3)由才德兼具的人士所經營(4)吸引人的價格,我們常常可以找到一些符合(1)(2)(3)項條件的投資標的,但第(4)項往往讓我們止步,舉例來說,1971年Berkshire所有股票的投資成本累計為1,070萬美元,市價則為1,170萬美元,市場上確實有不少好股票,只是他們的價格通常也不便宜,(講到這裡,我不得不補充,1971年全體退休基金經理人將可運用資金的122%投資在高價股票之上,甚至還嫌不夠,但到了1974年,當股市大幅回檔時,他們投資在股票的比例卻降到21%的歷史新低點)

The past few years have been a different story for us. At the end of 1975 our insurance subsidiaries held common equities with a market value exactly equal to cost of $39.3 million. At the end of 1978 this position had been increased to equities (including a convertible preferred) with a cost of $129.1 million and a market value of $216.5 million. During the intervening three years we also had realized pre-tax gains from common equities of approximately $24.7 million. Therefore, our overall unrealized and realized pre-tax gains in equities for the three year period came to approximately $112 million. During this same interval the Dow-Jones Industrial Average declined from 852 to 805. It was a marvelous period for the value-oriented equity buyer.

然而過去幾年的情況完全相反,1975年底我們旗下保險事業持有的股票市值與3,930萬美元的成本相當,到了1978年底股票部位(包含可轉換特別股)的投資成本增加為1.291億美元,市價則為2.165億美元,在這中間的三年內,我們另外還實現了2,470萬美元的資本利得,換句話說,這三年間,我們已實現與未實現的稅前資本利得達到1.12億美元,相較之下道瓊指數在同一期間卻由852點跌至805點,對於價值型投資人來說,這真是一段美好的歲月。

We continue to find for our insurance portfolios small portions of really outstanding businesses that are available, through the auction pricing mechanism of security markets, at prices dramatically cheaper than the valuations inferior businesses command on negotiated sales.

未來我們仍將持續為旗下的保險公司尋找真正優秀的事業,透過證券市場拍賣的價格機制,以比協議買進整家公司更便宜的價錢,取得一小部份的股權。

This program of acquisition of small fractions of businesses (common stocks) at bargain prices, for which little enthusiasm exists, contrasts sharply with general corporate acquisition activity, for which much enthusiasm exists. It seems quite clear to us that either corporations are making very significant mistakes in purchasing entire businesses at prices prevailing in negotiated transactions and takeover bids, or that we eventually are going to make considerable sums of money buying small portions of such businesses at the greatly discounted valuations prevailing in the stock market. (A second footnote: in 1978 pension managers, a group that logically should maintain the longest of investment perspectives, put only 9% of net available funds into equities - breaking the record low figure set in 1974 and tied in 1977.)

這種以划算的價格取得部份所有權(即股票)的計畫,雖然不像透過談判購併整家公司那麼有趣,但我們相當清楚,以目前的市場情況,很多公司因為透過協議談判的方式,犯了明顯的錯誤,相較之下,我們以划算的價格買進不少公司的部份所有權,反而賺了不少錢,(第二次補充,1978年許多退休基金經理人,原本最應該採取長期投資做法的一群人,平均只將9%的資金擺在股票之上,創下比1974年更低的比例)。

We are not concerned with whether the market quickly revalues upward securities that we believe are selling at bargain prices. In fact, we prefer just the opposite since, in most years, we expect to have funds available to be a net buyer of securities. And consistent attractive purchasing is likely to prove to be of more eventual benefit to us than any selling opportunities provided by a short-term run up in stock prices to levels at which we are unwilling to continue buying.

我們並不在乎市場是否會立即反應這些股價被低估的股票,事實上,我們寧願價格不要反應,因為通常我們不斷會有資金流入以供我們進場投資,持續不斷以便宜的價格買進最終將證明比趁短期股價上揚出脫持股所賺取的利益更多。

Our policy is to concentrate holdings. We try to avoid buying a little of this or that when we are only lukewarm about the business or its price. When we are convinced as to attractiveness, we believe in buying worthwhile amounts.

我們的投資策略是集中持股,我們試著盡量不要這也買一點,那也買一點,因為那樣會使得我們對於被投資的產業漠不關心,當我們覺得價格合理,我們就會一口氣大量地買進。

Equity holdings of our insurance companies with a market value of over $8 million on December 31, 1978 were as follows:

以下是1978年年底,我們旗下保險公司持股市價超過800萬美元的投資:

In some cases our indirect interest in earning power is becoming quite substantial. For example, note our holdings of 953,750 shares of SAFECO Corp. SAFECO probably is the best run large property and casualty insurance company in the United States. Their underwriting abilities are simply superb, their loss reserving is conservative, and their investment policies make great sense.

在某些情況下,我們間接持股的獲利能力變得相當的大,舉例來說,像是我們持有的953,750股的SAFECO股票,該公司大概是目前全美最優秀的大型產物意外險公司,他們的核保能力無與倫比,他們的損失準備提列相當保守,而他們的投資策略也相當合理。

SAFECO is a much better insurance operation than our own (although we believe certain segments of ours are much better than average), is better than one we could develop and, similarly, is far better than any in which we might negotiate purchase of a controlling interest. Yet our purchase of SAFECO was made at substantially under book value. We paid less than 100 cents on the dollar for the best company in the business, when far more than 100 cents on the dollar is being paid for mediocre companies in corporate transactions. And there is no way to start a new operation - with necessarily uncertain prospects - at less than 100 cents on the dollar.

SAFECO的保險事業營運績效遠優於我們(雖然我們相信自己旗下部份公司的表現優於其平均),比起我們自己可以發展的還要好,同時也遠優於我們可以透過協議買下具控制權的任何一家公司,然而我們仍然可以用遠低於其帳面價值的價格買到這些股票,我們以折扣的方式買進這家最優良公司的部份股權,相較之下,你可能必須以溢價的方式才能買到一整家表現平庸的公司,更何況先不考量不確定性,沒有人可以用打折的方式自行成立一家新事業。

Of course, with a minor interest we do not have the right to direct or even influence management policies of SAFECO. But why should we wish to do this? The record would indicate that they do a better job of managing their operations than we could do ourselves. While there may be less excitement and prestige in sitting back and letting others do the work, we think that is all one loses by accepting a passive participation in excellent management. Because, quite clearly, if one controlled a company run as well as SAFECO, the proper policy also would be to sit back and let management do its job.

當然僅有少數的股權,代表我們無權去指揮或影響SAFECO公司的經營決策,但我們為什麼要那樣做? 過去的記錄顯示他們營運管理的績效甚至比我們自己經營還要好,雖然閒坐一旁看別人表現,難免有點無趣且有傷自尊,但我們認為這本來就是被動參與某些優秀的經營階層所必須犧牲的,因為就算有人有幸得以取得SAFECO的控制權,最好的方式還是坐在一旁讓現有管理階層自由發揮。

Earnings attributable to the shares of SAFECO owned by Berkshire at yearend amounted to $6.1 million during 1978, but only the dividends received (about 18% of earnings) are reflected in our operating earnings. We believe the balance, although not reportable, to be just as real in terms of eventual benefit to us as the amount distributed. In fact, SAFECO’s retained earnings (or those of other well-run companies if they have opportunities to employ additional capital advantageously) may well eventually have a value to shareholders greater than 100 cents on the dollar.

1978年Berkshire持有的SAFECO公司股份可分配到的盈餘約為610萬美元,但最後反應在我們盈餘帳上的卻只有實際收到的股利收入(約佔總盈餘的18%),我們相信剩下的部份,雖然報表上看不到,其意義與我們實際收到的那一部份盈餘同等重要,事實上,保留在SAFECO公司帳上的盈餘(或是其他可以好好運用額外資金的那些好公司)將來一定可以為股東創造出更多的價值。

We are not at all unhappy when our wholly-owned businesses retain all of their earnings if they can utilize internally those funds at attractive rates. Why should we feel differently about retention of earnings by companies in which we hold small equity interests, but where the record indicates even better prospects for profitable employment of capital? (This proposition cuts the other way, of course, in industries with low capital requirements, or if management has a record of plowing capital into projects of low profitability; then earnings should be paid out or used to repurchase shares - often by far the most attractive option for capital utilization.)

我們並不反對旗下百分之百持有的子公司將所賺取的盈餘繼續保留在帳上,如果他們可以再利用這些資金創造更好的投資報酬,同樣地,對於其他持有少數股權的被投資公司,如果他們可以好好地運用這些資金,創造更好的報酬,我們何樂而不為,(這樣的前提,也意味著如果某些產業並不需要投入太多的資金或是管理階層過去有將資金浪擲在低投資報酬率的記錄的話,那麼盈餘就應該分還給股東或是拿來買回庫藏股,這是現有資金運用最好的選擇)。

The aggregate level of such retained earnings attributable to our equity interests in fine companies is becoming quite substantial. It does not enter into our reported operating earnings, but we feel it well may have equal long-term significance to our shareholders. Our hope is that conditions continue to prevail in securities markets which allow our insurance companies to buy large amounts of underlying earning power for relatively modest outlays. At some point market conditions undoubtedly will again preclude such bargain buying but, in the meantime, we will try to make the most of opportunities.

這些股權投資累積下來未分配的盈餘越來越可觀,雖然他們並未反應在我們的報表之上,但我們認為他們對於我們股東長遠利益的貢獻相當重要,我們期望股票市場能夠繼續維持現狀,好讓我們為旗下保險公司大量買進更多價廉物美的股票,雖然某些時候市場情況不一定會允許我們這樣做,但我們還是會繼續試著努力去尋找更多的機會。

Banking

銀行業

Under Gene Abegg and Pete Jeffrey, the Illinois National Bank and Trust Company in Rockford continues to establish new records. Last year’s earnings amounted to approximately 2.1% of average assets, about three times the level averaged by major banks. In our opinion, this extraordinary level of earnings is being achieved while maintaining significantly less asset risk than prevails at most of the larger banks.

在Gene Abegg及Pete Jeffrey的領導下,位於Rockford地區的伊利諾國家銀行及信託公司持續創造歷史新紀錄,去年的盈餘達到平均資產的2.1%,獲利率約是其他大銀行的三倍,我們認為有這樣的盈餘,同時還能夠兼顧規避其他銀行普遍存在的資產風險實在是難得。

We purchased the Illinois National Bank in March 1969. It was a first-class operation then, just as it had been ever since Gene Abegg opened the doors in 1931. Since 1968, consumer time deposits have quadrupled, net income has tripled and trust department income has more than doubled, while costs have been closely controlled.

我們是在1969年買下伊利諾國家銀行的,當時該公司的營運就屬一流,這項傳統打從1931年Gene Abegg創立時便一直維持到現在,自從1968年以來,銀行定期存款金額成長四倍、淨收入增加三倍而信託部門的收入也增加二倍,另外成本控制也相當得宜。

Our experience has been that the manager of an already high-cost operation frequently is uncommonly resourceful in finding new ways to add to overhead, while the manager of a tightly-run operation usually continues to find additional methods to curtail costs, even when his costs are already well below those of his competitors. No one has demonstrated this latter ability better than Gene Abegg.

依我們過去的經驗顯示,一家費用成本高公司的經營者,永遠找得到增加公司開支的藉口;而相對的,一家費用成本低的經營者,永遠找得到為公司節省開支的方法,即使後者的成本早已遠低於前者,這點我們在Gene Abegg得到充分的驗證。

We are required to divest our bank by December 31, 1980. The most likely approach is to spin it off to Berkshire shareholders some time in the second half of 1980.

我們被要求必須在1980年12月31日以前出脫銀行事業,最有可能的方式是在1980年中將銀行股份依持股比例分配給Berkshire的股東。

Retailing

零售業

Upon merging with Diversified, we acquired 100% ownership of Associated Retail Stores, Inc., a chain of about 75 popular priced women’s apparel stores. Associated was launched in Chicago on March 7, 1931 with one store, $3200, and two extraordinary partners, Ben Rosner and Leo Simon. After Mr. Simon’s death, the business was offered to Diversified for cash in 1967. Ben was to continue running the business - and run it, he has.

在與多元零售公司合併之後,我們取得聯合零售商店100%的股權,這是一家擁有75家女性流行服飾店的公司,聯合公司是在1931年在芝加哥由兩位創辦人Ben Rosner及Leo Simon以3,200美元開立第一家店面,在Simon先生死後,由多元零售公司在1967年以現金買下,並由Ben照原來方式繼續經營這家公司。

Associated’s business has not grown, and it consistently has faced adverse demographic and retailing trends. But Ben’s combination of merchandising, real estate and cost-containment skills has produced an outstanding record of profitability, with returns on capital necessarily employed in the business often in the 20% after-tax area.

雖然聯合商店的業務因為面臨地區以及零售趨勢的困境而停滯不前,但Ben在商品販售、不動產以及成本控制的能力依舊讓公司創造出優異的獲利成績,使得資金運用的報酬率達到20%股東權益稅後報酬率之譜。

Ben is now 75 and, like Gene Abegg, 81, at Illinois National and Louie Vincenti, 73, at Wesco, continues daily to bring an almost passionately proprietary attitude to the business. This group of top managers must appear to an outsider to be an overreaction on our part to an OEO bulletin on age discrimination. While unorthodox, these relationships have been exceptionally rewarding, both financially and personally. It is a real pleasure to work with managers who enjoy coming to work each morning and, once there, instinctively and unerringly think like owners. We are associated with some of the very best.

Ben今年75歲,但與伊利諾國家銀行81歲的Gene Abegg以及Wesco 73歲的Louie Vincenti一樣,每天依舊為所領導的企業灌注無比的熱情與活力,外界不知情的人還以為我們對於這群傑出的經理人有年齡上的特殊偏好,雖然極不尋常,但這樣的關係實在是讓我們受益良多,無論是在財務上或精神上都是如此,與這群「樂在其中」並以像老板一樣心態每天認真經營公司的專業經理人在一起工作實在是一種享受。

Warren E. Buffett, Chairman

March 26, 1979

華倫.巴菲特

董事會主席

1979年3月26日

波克夏海瑟崴股份有限公司

To the Shareholders of Berkshire Hathaway Inc.:

致Berkshire公司全體股東:

First, a few words about accounting. The merger with Diversified Retailing Company, Inc. at yearend adds two new complications in the presentation of our financial results. After the merger, our ownership of Blue Chip Stamps increased to approximately 58% and, therefore, the accounts of that company must be fully consolidated in the Balance Sheet and Statement of Earnings presentation of Berkshire. In previous reports, our share of the net earnings only of Blue Chip had been included as a single item on Berkshire’s Statement of Earnings, and there had been a similar one-line inclusion on our Balance Sheet of our share of their net assets.

首先,是會計相關的議題,在年底與多元零售公司的合併後,對於公司的財務報表有兩項影響,首先在合併案完成後,我們對藍籌郵票的持股比例將提高至58%左右,意味著該公司的資產負債以及盈餘數字必須全部納到Berkshire的報表之內,在此之前,我們僅透過權益法按投資比例認列藍籌郵票的淨值與收益。

This full consolidation of sales, expenses, receivables, inventories, debt, etc. produces an aggregation of figures from many diverse businesses - textiles, insurance, candy, newspapers, trading stamps - with dramatically different economic characteristics. In some of these your ownership is 100% but, in those businesses which are owned by Blue Chip but fully consolidated, your ownership as a Berkshire shareholder is only 58%. (Ownership by others of the balance of these businesses is accounted for by the large minority interest item on the liability side of the Balance Sheet.) Such a grouping of Balance Sheet and Earnings items - some wholly owned, some partly owned - tends to obscure economic reality more than illuminate it. In fact, it represents a form of presentation that we never prepare for internal use during the year and which is of no value to us in any management activities.

如此全面性地將營收、費用、應收帳款、存貨及負債等科目合併,所產生的數字將來自於各種產業特性截然不同的行業,包含紡織、保險、糖果、報紙及郵票等,某些行業各位的持有的權益是100%,某些例如由藍籌郵票所持有的卻只有58%(至於其他股東所代表的權益,則列在資產負債表右半邊負債科目的少數股東權益項下),對於財務報表這樣的歸類,我們認為非但無法解釋實際現況反而模糊了真正的焦點,事實上,我們內部從來就不使用這樣的報表進行分析管理。

For that reason, throughout the report we provide much separate financial information and commentary on the various segments of the business to help you evaluate Berkshire’s performance and prospects. Much of this segmented information is mandated by SEC disclosure rules and covered in “Management’s Discussion” on pages 29 to 34. And in this letter we try to present to you a view of our various operating entities from the same perspective that we view them managerially.

基於這樣的理由,在接下來的報告中,我們將針對個別的行業提供各自的財務數字及分析檢討,以協助各位評估Berkshire實際的表現及前景,這些資訊大都是證管會資訊揭露的相關要求,詳見29頁到34頁的管理階層討論,至於在這裡我們則試著以經營者的角度為各位分析各個營利單位的表現。

A second complication arising from the merger is that the 1977 figures shown in this report are different from the 1977 figures shown in the report we mailed to you last year. Accounting convention requires that when two entities such as Diversified and Berkshire are merged, all financial data subsequently must be presented as if the companies had been merged at the time they were formed rather than just recently. So the enclosed financial statements, in effect, pretend that in 1977 (and earlier years) the Diversified-Berkshire merger already had taken place, even though the actual merger date was December 30, 1978. This shifting base makes comparative commentary confusing and, from time to time in our narrative report, we will talk of figures and performance for Berkshire shareholders as historically reported to you rather than as restated after the Diversified merger.

合併案所引發的第二項影響則是今年報表中秀出1977年的數字與去年提供給各位同一年度的數字有所不同,會計原則要求當像多元零售與Berkshire這樣二個獨立個體合併時,所有報告的財務數字都必須假設這兩家公司原本就在一起,所以後續呈現所有數字,是假設這兩家公司早在1977年(甚至更早以前)就已經合併,雖然真正合併的日期是1978年的12月30日,這樣的改變使得比較性的評論很容易產生混淆,因為以往的報告中,我們告訴各位的都是Berkshire的歷史記錄,而非依照合併多元零售後重新修正數字。

With that preamble it can be stated that, with or without restated figures, 1978 was a good year. Operating earnings, exclusive of capital gains, at 19.4% of beginning shareholders’ investment were within a fraction of our 1972 record. While we believe it is improper to include capital gains or losses in evaluating the performance of a single year, they are an important component of the longer term record. Because of such gains, Berkshire’s long-term growth in equity per share has been greater than would be indicated by compounding the returns from operating earnings that we have reported annually.

然而即便在這樣的前提下,我們還是可以如此說,不論財報數字是否重編,1978年都是豐收的一年,不含資本利得的營業利益約為期初股東投資成本的19.4%,雖然低於1972年的歷史記錄,我們認為評估單一年度的表現,不適宜將資本利得或損失納入計算,但不可否認他們卻是衡量長期績效的重要指標,拜這類利得所賜,Berkshire每股權益長期的成長率遠大於每年年度營業利益所帶來的複利報酬。

For example, over the last three years - generally a bonanza period for the insurance industry, our largest profit producer - Berkshire’s per share net worth virtually has doubled, thereby compounding at about 25% annually through a combination of good operating earnings and fairly substantial capital gains. Neither this 25% equity gain from all sources nor the 19.4% equity gain from operating earnings in 1978 is sustainable. The insurance cycle has turned downward in 1979, and it is almost certain that operating earnings measured by return on equity will fall this year. However, operating earnings measured in dollars are likely to increase on the much larger shareholders’ equity now employed in the business.

舉例來說,過去三年算是保險業的黃金歲月,這行業也是Berkshire獲利主要來源,拜其所賜我們的每股淨值呈倍數成長,每年的營業利益與資本利得約當以25%的速度增加,但我們不認為25%的股東權益年成長或19.4%營業利益的年成長可以維持多久,保險業的景氣循環已於1979年開始反轉向下,所以今年的營業利益相較於股東權益的比率很有可能會下滑,當然營業利益的金額還是會繼續增加。

In contrast to this cautious view about near term return from operations, we are optimistic about prospects for long term return from major equity investments held by our insurance companies. We make no attempt to predict how security markets will behave; successfully forecasting short term stock price movements is something we think neither we nor anyone else can do. In the longer run, however, we feel that many of our major equity holdings are going to be worth considerably more money than we paid, and that investment gains will add significantly to the operating returns of the insurance group.

相較於對短期營運的保守看法,我們對於目前保險子公司所持有的股票投資卻感到相當樂觀,我們從來不會想要去預測股票市場的走勢,事實上,我不認為包含我自己本身在內,有人能夠「成功」地預測股市短期間的波動,然而就長期而言,我們覺得我們這些主要持股的價值終將遠超過我們當初投資的成本,而這些投資收益將會使得保險事業的盈餘表現更上一層樓。

Sources of Earnings

盈餘報告

To give you a better picture of just where Berkshire’s earnings are produced, we show below a table which requires a little explanation. Berkshire owns close to 58% of Blue Chip which, in addition to 100% ownership of several businesses, owns 80% of Wesco Financial Corporation. Thus, Berkshire’s equity in Wesco’s earnings is about 46%. In aggregate, businesses that we control have about 7,000 full-time employees and generate revenues of over $500 million.

為了讓各位對Berkshire的盈餘來源有所了解,讓我稍微解釋一下下面這張表,Berkshire約持有藍籌郵票58%的股權,而後者除了持有一些企業100%的股權外,還另外擁有Wesco金融公司80%的股權,也因此Berkshire等於間接持有Wesco約46%的股權,總的來說,我們旗下事業約有7,000名全職的員工,年營收達到5億美元。

The table shows the overall earnings of each major operating category on a pre-tax basis (several of the businesses have low tax rates because of significant amounts of tax-exempt interest and dividend income), as well as the share of those earnings belonging to Berkshire both on a pre-tax and after-tax basis. Significant capital gains or losses attributable to any of the businesses are not shown in the operating earnings figure, but are aggregated on the “Realized Securities Gain” line at the bottom of the table. Because of various accounting and tax intricacies, the figures in the table should not be treated as holy writ, but rather viewed as close approximations of the 1977 and 1978 earnings contributions of our constituent businesses.

下表顯示各個主要營運單位的稅前盈餘(有幾家公司適用的稅率較低主要的原因是免稅的利息及股息收入),以下是Berkshire按持股比例可分得的稅前及稅後盈餘,各事業的資本利得或損失則不包含在營業利益之內,而是加總列在已實現證券利得項下,由於複雜的會計及稅務規定,大家不必將這些數字看得很神聖,最好是單純地把他們當作是旗下事業在1977年及1978年對於母公司所貢獻的盈餘。

Blue Chip and Wesco are public companies with reporting requirements of their own. Later in this report we are reproducing the narrative reports of the principal executives of both companies, describing their 1978 operations. Some of the figures they utilize will not match to the penny the ones we use in this report, again because of accounting and tax complexities. But their comments should be helpful to you in understanding the underlying economic characteristics of these important partly-owned businesses. A copy of the full annual report of either company will be mailed to any shareholder of Berkshire upon request to Mr. Robert H. Bird for Blue Chips Stamps, 5801 South Eastern Avenue, Los Angeles, California 90040, or to Mrs. Bette Deckard for Wesco Financial Corporation, 315 East Colorado Boulevard, Pasadena, California 91109.

藍籌郵票及Wesco都是公開發行公司,各自都必須對外公開報告,在年報的後段附有這兩家公司主要經理人關於公司1978年現況的書面報告,他們運用的部份數字可能無法與我們的報告絲毫不差,這又是因為會計與稅務一些細節規定所致,但我認為他們的見解將有助於各位了解這些旗下重要事業的經營現況,若有需要Berkshire的股東可向Mr. Robert(地址:加州洛杉磯5801 South Eastern Avenue)索取藍籌郵票的年報或向Mrs. Bette(地址:加州Pasadena 315 East Colorado Boulevard)索取Wesco的年報。

Textiles

紡織業

Earnings of $1.3 million in 1978, while much improved from 1977, still represent a low return on the $17 million of capital employed in this business. Textile plant and equipment are on the books for a very small fraction of what it would cost to replace such equipment today. And, despite the age of the equipment, much of it is functionally similar to new equipment being installed by the industry. But despite this “bargain cost” of fixed assets, capital turnover is relatively low reflecting required high investment levels in receivables and inventory compared to sales. Slow capital turnover, coupled with low profit margins on sales, inevitably produces inadequate returns on capital. Obvious approaches to improved profit margins involve differentiation of product, lowered manufacturing costs through more efficient equipment or better utilization of people, redirection toward fabrics enjoying stronger market trends, etc. Our management is diligent in pursuing such objectives. The problem, of course, is that our competitors are just as diligently doing the same thing.

1978年的盈餘達到130萬美元,較1977年有所改進,但相較於投入的1,700萬資本來說,報酬率還是很低,目前紡織廠房及設備帳列的價值遠低於未來重置所需的成本,雖然這些設備都已相當老舊,但大部分的功能與目前同業所採用的全新設備差異並不大,但盡管固定資產的投入不須太大,但銷售所須負擔的應收帳款及存貨週轉資金卻是相當沈重的擔子,紡織業低資產週轉率與低毛利無可避免地造成低落的股東權益報酬率,可能的改善方式包括產品差異化、使用新設備降低製造成本或妥善運用人力、朝高附加價值的紡織品轉型等,我們的管理階層正致力達到以上目標,當然真正的問題在於這也正是我們的競爭同業正在努力做的。

The textile industry illustrates in textbook style how producers of relatively undifferentiated goods in capital intensive businesses must earn inadequate returns except under conditions of tight supply or real shortage. As long as excess productive capacity exists, prices tend to reflect direct operating costs rather than capital employed. Such a supply-excess condition appears likely to prevail most of the time in the textile industry, and our expectations are for profits of relatively modest amounts in relation to capital.

紡織業的現況充分地說明了教科書中提到的,當資本密集但產品無重大差異化的生產者註定將賺取微薄的報酬,除非供給吃緊或真正短缺,只要市場產能過剩,產品價格就會隨直接營運成本而非投入資金作變動,不幸的是這樣的情況正是目前紡織業的常態,所以我們只能期望獲取稍微合理的投資報酬即可。

We hope we don’t get into too many more businesses with such tough economic characteristics. But, as we have stated before: (1) our textile businesses are very important employers in their communities, (2) management has been straightforward in reporting on problems and energetic in attacking them, (3) labor has been cooperative and understanding in facing our common problems, and (4) the business should average modest cash returns relative to investment. As long as these conditions prevail - and we expect that they will - we intend to continue to support our textile business despite more attractive alternative uses for capital.

我們希望以後不要再介入這類產業面臨困境的企業,但就像之前曾經提到的,只要(1) 該公司為當地非常重要的雇主(2)管理當局坦誠面對困境並努力解決問題(3)勞工體認現況並極力配合(4)相對於投入的資金,尚能產生穩定現金收入。只要以上前提存在,我們也相信一定會,我們就會繼續支持紡織事業的營運,雖然這樣將使得我們被迫放棄其他更有利的資金運用管道。

Insurance Underwriting

保險核保業務

The number one contributor to Berkshire’s overall excellent results in 1978 was the segment of National Indemnity Company’s insurance operation run by Phil Liesche. On about $90 million of earned premiums, an underwriting profit of approximately $11 million was realized, a truly extraordinary achievement even against the background of excellent industry conditions. Under Phil’s leadership, with outstanding assistance by Roland Miller in Underwriting and Bill Lyons in Claims, this segment of National Indemnity (including National Fire and Marine Insurance Company, which operates as a running mate) had one of its best years in a long history of performances which, in aggregate, far outshine those of the industry. Present successes reflect credit not only upon present managers, but equally upon the business talents of Jack Ringwalt, founder of National Indemnity, whose operating philosophy remains etched upon the company.

1978年Berkshire盈餘貢獻的第一功臣當屬由Phil Liesche所帶領的國家產險公司,在所賺取的9,000萬美元保費收入當中,有1,100萬美元是已實現的核保利益,即便是產業情況不錯的環境下仍屬相當難得,在Phil的領導以及Roland Miller核保部門與Bill Lyons理賠部門的襄助之下,國家產險(包含國家火海險公司)創下有史以來表現最佳的一年,其表現更遠優於其他同業,如今的成功不僅反應出現任經營者的功勞,還要歸功於國家產險創辦人Jack Ringwalt的遠見,其經營哲學目前仍深深烙印在公司之上。

Home and Automobile Insurance Company had its best year since John Seward stepped in and straightened things out in 1975. Its results are combined in this report with those of Phil Liesche’s operation under the insurance category entitled “Specialized Auto and General Liability”.

去年是家庭汽車保險公司自1975年John Seward介入並改正公司營運以來表現最佳的一年,其成績連同Phil的營運績效一起被放在特殊汽車及一般責任險業務範圍之內。

Worker’s Compensation was a mixed bag in 1978. In its first year as a subsidiary, Cypress Insurance Company, managed by Milt Thornton, turned in outstanding results. The worker’s compensation line can cause large underwriting losses when rapid inflation interacts with changing social concepts, but Milt has a cautious and highly professional staff to cope with these problems. His performance in 1978 has reinforced our very good feelings about this purchase.

1978年勞工退休保險是一個混合體,在她被列為Milt Thornton管理的Cypress保險公司子公司的第一年便繳出漂亮的成績單,勞工退休保險業務在通貨膨脹加劇以及社會觀念改變的情況下,有可能產生鉅額的核保損失,但Milt擁有一組謹慎且極度專業的團隊小心處理這些問題, 1978年他的表現使我們對於買進這項業務開始有不錯的感覺。

Frank DeNardo came with us in the spring of 1978 to straighten out National Indemnity’s California Worker’s Compensation business which, up to that point, had been a disaster. Frank has the experience and intellect needed to correct the major problems of the Los Angeles office. Our volume in this department now is running only about 25% of what it was eighteen months ago, and early indications are that Frank is making good progress.

Frank DeNardo是在1978年春天加入我們改正國家產險在加州勞工退休保險業務的行列,當時這項業務可以說是一場災難,Frank具有導正加州辦公室問題所需的經驗與智慧,目前這個部門的業務量只有一年半前的四分之一,初步的結果顯示Frank已有相當好的開始。

George Young’s reinsurance department continues to produce very large sums for investment relative to premium volume, and thus gives us reasonably satisfactory overall results. However, underwriting results still are not what they should be and can be. It is very easy to fool yourself regarding underwriting results in reinsurance (particularly in casualty lines involving long delays in settlement), and we believe this situation prevails with many of our competitors. Unfortunately, self-delusion in company reserving almost always leads to inadequate industry rate levels. If major factors in the market don’t know their true costs, the competitive “fall-out” hits all - even those with adequate cost knowledge. George is quite willing to reduce volume significantly, if needed, to achieve satisfactory underwriting, and we have a great deal of confidence in the long term soundness of this business under his direction.

George Young的再保險部門創造的保費收入持續挹注投資所需的大量資金,並繳出相當令人滿意的成績單,只是核保部門的績效依舊不如預期理想,再保險的核保成績很容易讓人搞錯(尤其是理賠時間通常拉得很長的意外險業務),而我們相信其他同業普遍也面臨這樣的問題,不幸的是,公司損失準備提列的自我迷惑通常導致不當的保險費率結構,如果市場上的主要份子對於自身的成本結構不甚了解,那麼競爭爆炸的結果是傷到所有的參與者,也包含那些具有成本意識的業者在內,如果有必要的話,為達到合理的核保績效,George寧願捨棄大部分的業務,而我們也有信心就長期而言,這項業務在他的領導之下會有不錯的表現。

The homestate operation was disappointing in 1978. Our unsatisfactory underwriting, even though partially explained by an unusual incidence of Midwestern storms, is particularly worrisome against the backdrop of very favorable industry results in the conventional lines written by our homestate group. We have confidence in John Ringwalt’s ability to correct this situation. The bright spot in the group was the performance of Kansas Fire and Casualty in its first full year of business. Under Floyd Taylor, this subsidiary got off to a truly remarkable start. Of course, it takes at least several years to evaluate underwriting results, but the early signs are encouraging and Floyd’s operation achieved the best loss ratio among the homestate companies in 1978.

Homestate 1978年的營運讓人感到相當失望,雖然核保績效差,部份的原因要歸咎於中西部意外發生的風暴,但是一向表現優異的傳統保單業務惡化的情況卻特別令人感到憂心,我們對於John Ringwalt導正這種情況的能力有信心,堪薩斯火險第一個完整會計年度不錯的表現讓我們吃下一棵定心丸,在Floyd Taylor的領導下,這個分支單位有一個非常好的開始,當然至少要好幾年才能評估其真正的核保績效,但初步的結果令人感到相當振奮,而Floyd 1978年的損失比率也是Homestate所有單位中表現最佳的。

Although some segments were disappointing, overall our insurance operation had an excellent year. But of course we should expect a good year when the industry is flying high, as in 1978. It is a virtual certainty that in 1979 the combined ratio (see definition on page 31) for the industry will move up at least a few points, perhaps enough to throw the industry as a whole into an underwriting loss position. For example, in the auto lines - by far the most important area for the industry and for us - CPI figures indicate rates overall were only 3% higher in January 1979 than a year ago. But the items that make up loss costs - auto repair and medical care costs - were up over 9%. How different than yearend 1976 when rates had advanced over 22% in the preceding twelve months, but costs were up 8%.

雖然某些單位的績效令人感到失望,但總的來說,我們保險事業還是渡過了豐收的一年,當然就像1978年一樣,在整個產業預期相對樂觀的情況下,我們還是期待來年的豐收,幾乎可以肯定的是1979年整個產業的綜合比率(定義請參閱第31頁)將會上揚幾個百分點,甚至有可能使得整個產業平均面臨核保損失的情況,比如以目前產險業中最重要的車險業務來說,1979年一月顯示消費者物價指數僅比去年同期增加3個百分點,但是損失成本-包含修理及醫療費用的支出卻上揚的9個百分點,這與1976年物價指數上揚22百分點但相關成本僅增加8個百分點的情況,有很大的不同。

Margins will remain steady only if rates rise as fast as costs. This assuredly will not be the case in 1979, and conditions probably will worsen in 1980. Our present thinking is that our underwriting performance relative to the industry will improve somewhat in 1979, but every other insurance management probably views its relative prospects with similar optimism - someone is going to be disappointed. Even if we do improve relative to others, we may well have a higher combined ratio and lower underwriting profits in 1979 than we achieved last year.

只有當費率增加的幅度與成本上揚的速度一致時,才得以維持穩定的利潤空間,但很顯然1979年的情況並非如此,而1980年甚至有可能還會繼續惡化,我們現在的想法是我們1979年的核保績效應該會比同業好一點,但其他保險同業或許也抱持著跟我們相同的看法,所以可以肯定的是其他一定有人會失望,而就算我們比其他同業表現要好一點,我們的綜合比率還是有可能進一步提高,使得我們1979年的核保利益就去年衰退。

We continue to look for ways to expand our insurance operation. But your reaction to this intent should not be unrestrained joy. Some of our expansion efforts - largely initiated by your Chairman have been lackluster, others have been expensive failures. We entered the business in 1967 through purchase of the segment which Phil Liesche now manages, and it still remains, by a large margin, the best portion of our insurance business. It is not easy to buy a good insurance business, but our experience has been that it is easier to buy one than create one. However, we will continue to try both approaches, since the rewards for success in this field can be exceptional.

另外一方面,我們還是不斷尋求增加保險業務的機會,不過各位對於我們這樣的企圖千萬不要一面倒地感到高興,我們一些擴張的努力,大部分都是由我本人所發起的,事後證明都是半調子,有的還付出昂貴的代價,事實上,經由買進Phil Liesche的業務,我們在1967年進入保險事業,而到目前為止,這個部門還是我們所有保險事業中表現最好的,實在是很難買到一家好的保險公司,但要創立一家更難,然而我們還是會不斷地用各種方法,因為一旦成功所獲得的回報是相當驚人的。

Insurance Investments

保險事業的投資

We confess considerable optimism regarding our insurance equity investments. Of course, our enthusiasm for stocks is not unconditional. Under some circumstances, common stock investments by insurers make very little sense.

我們必須承認對於保險事業的股票投資有點過於樂觀,當然我們對於股票的偏愛並非毫無限制,在某些情況下,保險公司投資股票一點意義都沒有。

We get excited enough to commit a big percentage of insurance company net worth to equities only when we find (1) businesses we can understand, (2) with favorable long-term prospects, (3) operated by honest and competent people, and (4) priced very attractively. We usually can identify a small number of potential investments meeting requirements (1), (2) and (3), but (4) often prevents action. For example, in 1971 our total common stock position at Berkshire’s insurance subsidiaries amounted to only $10.7 million at cost, and $11.7 million at market. There were equities of identifiably excellent companies available - but very few at interesting prices. (An irresistible footnote: in 1971, pension fund managers invested a record 122% of net funds available in equities - at full prices they couldn’t buy enough of them. In 1974, after the bottom had fallen out, they committed a then record low of 21% to stocks.)

只有當以下條件都符合時,我們才會想要將保險公司大部分的資金投入到股票投資之上:(1)我們可以了解的行業(2)具有長期競爭力(3)由才德兼具的人士所經營(4)吸引人的價格,我們常常可以找到一些符合(1)(2)(3)項條件的投資標的,但第(4)項往往讓我們止步,舉例來說,1971年Berkshire所有股票的投資成本累計為1,070萬美元,市價則為1,170萬美元,市場上確實有不少好股票,只是他們的價格通常也不便宜,(講到這裡,我不得不補充,1971年全體退休基金經理人將可運用資金的122%投資在高價股票之上,甚至還嫌不夠,但到了1974年,當股市大幅回檔時,他們投資在股票的比例卻降到21%的歷史新低點)

The past few years have been a different story for us. At the end of 1975 our insurance subsidiaries held common equities with a market value exactly equal to cost of $39.3 million. At the end of 1978 this position had been increased to equities (including a convertible preferred) with a cost of $129.1 million and a market value of $216.5 million. During the intervening three years we also had realized pre-tax gains from common equities of approximately $24.7 million. Therefore, our overall unrealized and realized pre-tax gains in equities for the three year period came to approximately $112 million. During this same interval the Dow-Jones Industrial Average declined from 852 to 805. It was a marvelous period for the value-oriented equity buyer.

然而過去幾年的情況完全相反,1975年底我們旗下保險事業持有的股票市值與3,930萬美元的成本相當,到了1978年底股票部位(包含可轉換特別股)的投資成本增加為1.291億美元,市價則為2.165億美元,在這中間的三年內,我們另外還實現了2,470萬美元的資本利得,換句話說,這三年間,我們已實現與未實現的稅前資本利得達到1.12億美元,相較之下道瓊指數在同一期間卻由852點跌至805點,對於價值型投資人來說,這真是一段美好的歲月。

We continue to find for our insurance portfolios small portions of really outstanding businesses that are available, through the auction pricing mechanism of security markets, at prices dramatically cheaper than the valuations inferior businesses command on negotiated sales.

未來我們仍將持續為旗下的保險公司尋找真正優秀的事業,透過證券市場拍賣的價格機制,以比協議買進整家公司更便宜的價錢,取得一小部份的股權。

This program of acquisition of small fractions of businesses (common stocks) at bargain prices, for which little enthusiasm exists, contrasts sharply with general corporate acquisition activity, for which much enthusiasm exists. It seems quite clear to us that either corporations are making very significant mistakes in purchasing entire businesses at prices prevailing in negotiated transactions and takeover bids, or that we eventually are going to make considerable sums of money buying small portions of such businesses at the greatly discounted valuations prevailing in the stock market. (A second footnote: in 1978 pension managers, a group that logically should maintain the longest of investment perspectives, put only 9% of net available funds into equities - breaking the record low figure set in 1974 and tied in 1977.)

這種以划算的價格取得部份所有權(即股票)的計畫,雖然不像透過談判購併整家公司那麼有趣,但我們相當清楚,以目前的市場情況,很多公司因為透過協議談判的方式,犯了明顯的錯誤,相較之下,我們以划算的價格買進不少公司的部份所有權,反而賺了不少錢,(第二次補充,1978年許多退休基金經理人,原本最應該採取長期投資做法的一群人,平均只將9%的資金擺在股票之上,創下比1974年更低的比例)。

We are not concerned with whether the market quickly revalues upward securities that we believe are selling at bargain prices. In fact, we prefer just the opposite since, in most years, we expect to have funds available to be a net buyer of securities. And consistent attractive purchasing is likely to prove to be of more eventual benefit to us than any selling opportunities provided by a short-term run up in stock prices to levels at which we are unwilling to continue buying.

我們並不在乎市場是否會立即反應這些股價被低估的股票,事實上,我們寧願價格不要反應,因為通常我們不斷會有資金流入以供我們進場投資,持續不斷以便宜的價格買進最終將證明比趁短期股價上揚出脫持股所賺取的利益更多。

Our policy is to concentrate holdings. We try to avoid buying a little of this or that when we are only lukewarm about the business or its price. When we are convinced as to attractiveness, we believe in buying worthwhile amounts.

我們的投資策略是集中持股,我們試著盡量不要這也買一點,那也買一點,因為那樣會使得我們對於被投資的產業漠不關心,當我們覺得價格合理,我們就會一口氣大量地買進。

Equity holdings of our insurance companies with a market value of over $8 million on December 31, 1978 were as follows:

以下是1978年年底,我們旗下保險公司持股市價超過800萬美元的投資:

In some cases our indirect interest in earning power is becoming quite substantial. For example, note our holdings of 953,750 shares of SAFECO Corp. SAFECO probably is the best run large property and casualty insurance company in the United States. Their underwriting abilities are simply superb, their loss reserving is conservative, and their investment policies make great sense.

在某些情況下,我們間接持股的獲利能力變得相當的大,舉例來說,像是我們持有的953,750股的SAFECO股票,該公司大概是目前全美最優秀的大型產物意外險公司,他們的核保能力無與倫比,他們的損失準備提列相當保守,而他們的投資策略也相當合理。

SAFECO is a much better insurance operation than our own (although we believe certain segments of ours are much better than average), is better than one we could develop and, similarly, is far better than any in which we might negotiate purchase of a controlling interest. Yet our purchase of SAFECO was made at substantially under book value. We paid less than 100 cents on the dollar for the best company in the business, when far more than 100 cents on the dollar is being paid for mediocre companies in corporate transactions. And there is no way to start a new operation - with necessarily uncertain prospects - at less than 100 cents on the dollar.

SAFECO的保險事業營運績效遠優於我們(雖然我們相信自己旗下部份公司的表現優於其平均),比起我們自己可以發展的還要好,同時也遠優於我們可以透過協議買下具控制權的任何一家公司,然而我們仍然可以用遠低於其帳面價值的價格買到這些股票,我們以折扣的方式買進這家最優良公司的部份股權,相較之下,你可能必須以溢價的方式才能買到一整家表現平庸的公司,更何況先不考量不確定性,沒有人可以用打折的方式自行成立一家新事業。

Of course, with a minor interest we do not have the right to direct or even influence management policies of SAFECO. But why should we wish to do this? The record would indicate that they do a better job of managing their operations than we could do ourselves. While there may be less excitement and prestige in sitting back and letting others do the work, we think that is all one loses by accepting a passive participation in excellent management. Because, quite clearly, if one controlled a company run as well as SAFECO, the proper policy also would be to sit back and let management do its job.

當然僅有少數的股權,代表我們無權去指揮或影響SAFECO公司的經營決策,但我們為什麼要那樣做? 過去的記錄顯示他們營運管理的績效甚至比我們自己經營還要好,雖然閒坐一旁看別人表現,難免有點無趣且有傷自尊,但我們認為這本來就是被動參與某些優秀的經營階層所必須犧牲的,因為就算有人有幸得以取得SAFECO的控制權,最好的方式還是坐在一旁讓現有管理階層自由發揮。

Earnings attributable to the shares of SAFECO owned by Berkshire at yearend amounted to $6.1 million during 1978, but only the dividends received (about 18% of earnings) are reflected in our operating earnings. We believe the balance, although not reportable, to be just as real in terms of eventual benefit to us as the amount distributed. In fact, SAFECO’s retained earnings (or those of other well-run companies if they have opportunities to employ additional capital advantageously) may well eventually have a value to shareholders greater than 100 cents on the dollar.

1978年Berkshire持有的SAFECO公司股份可分配到的盈餘約為610萬美元,但最後反應在我們盈餘帳上的卻只有實際收到的股利收入(約佔總盈餘的18%),我們相信剩下的部份,雖然報表上看不到,其意義與我們實際收到的那一部份盈餘同等重要,事實上,保留在SAFECO公司帳上的盈餘(或是其他可以好好運用額外資金的那些好公司)將來一定可以為股東創造出更多的價值。

We are not at all unhappy when our wholly-owned businesses retain all of their earnings if they can utilize internally those funds at attractive rates. Why should we feel differently about retention of earnings by companies in which we hold small equity interests, but where the record indicates even better prospects for profitable employment of capital? (This proposition cuts the other way, of course, in industries with low capital requirements, or if management has a record of plowing capital into projects of low profitability; then earnings should be paid out or used to repurchase shares - often by far the most attractive option for capital utilization.)

我們並不反對旗下百分之百持有的子公司將所賺取的盈餘繼續保留在帳上,如果他們可以再利用這些資金創造更好的投資報酬,同樣地,對於其他持有少數股權的被投資公司,如果他們可以好好地運用這些資金,創造更好的報酬,我們何樂而不為,(這樣的前提,也意味著如果某些產業並不需要投入太多的資金或是管理階層過去有將資金浪擲在低投資報酬率的記錄的話,那麼盈餘就應該分還給股東或是拿來買回庫藏股,這是現有資金運用最好的選擇)。

The aggregate level of such retained earnings attributable to our equity interests in fine companies is becoming quite substantial. It does not enter into our reported operating earnings, but we feel it well may have equal long-term significance to our shareholders. Our hope is that conditions continue to prevail in securities markets which allow our insurance companies to buy large amounts of underlying earning power for relatively modest outlays. At some point market conditions undoubtedly will again preclude such bargain buying but, in the meantime, we will try to make the most of opportunities.

這些股權投資累積下來未分配的盈餘越來越可觀,雖然他們並未反應在我們的報表之上,但我們認為他們對於我們股東長遠利益的貢獻相當重要,我們期望股票市場能夠繼續維持現狀,好讓我們為旗下保險公司大量買進更多價廉物美的股票,雖然某些時候市場情況不一定會允許我們這樣做,但我們還是會繼續試著努力去尋找更多的機會。

Banking

銀行業

Under Gene Abegg and Pete Jeffrey, the Illinois National Bank and Trust Company in Rockford continues to establish new records. Last year’s earnings amounted to approximately 2.1% of average assets, about three times the level averaged by major banks. In our opinion, this extraordinary level of earnings is being achieved while maintaining significantly less asset risk than prevails at most of the larger banks.

在Gene Abegg及Pete Jeffrey的領導下,位於Rockford地區的伊利諾國家銀行及信託公司持續創造歷史新紀錄,去年的盈餘達到平均資產的2.1%,獲利率約是其他大銀行的三倍,我們認為有這樣的盈餘,同時還能夠兼顧規避其他銀行普遍存在的資產風險實在是難得。

We purchased the Illinois National Bank in March 1969. It was a first-class operation then, just as it had been ever since Gene Abegg opened the doors in 1931. Since 1968, consumer time deposits have quadrupled, net income has tripled and trust department income has more than doubled, while costs have been closely controlled.

我們是在1969年買下伊利諾國家銀行的,當時該公司的營運就屬一流,這項傳統打從1931年Gene Abegg創立時便一直維持到現在,自從1968年以來,銀行定期存款金額成長四倍、淨收入增加三倍而信託部門的收入也增加二倍,另外成本控制也相當得宜。

Our experience has been that the manager of an already high-cost operation frequently is uncommonly resourceful in finding new ways to add to overhead, while the manager of a tightly-run operation usually continues to find additional methods to curtail costs, even when his costs are already well below those of his competitors. No one has demonstrated this latter ability better than Gene Abegg.

依我們過去的經驗顯示,一家費用成本高公司的經營者,永遠找得到增加公司開支的藉口;而相對的,一家費用成本低的經營者,永遠找得到為公司節省開支的方法,即使後者的成本早已遠低於前者,這點我們在Gene Abegg得到充分的驗證。

We are required to divest our bank by December 31, 1980. The most likely approach is to spin it off to Berkshire shareholders some time in the second half of 1980.

我們被要求必須在1980年12月31日以前出脫銀行事業,最有可能的方式是在1980年中將銀行股份依持股比例分配給Berkshire的股東。

Retailing

零售業

Upon merging with Diversified, we acquired 100% ownership of Associated Retail Stores, Inc., a chain of about 75 popular priced women’s apparel stores. Associated was launched in Chicago on March 7, 1931 with one store, $3200, and two extraordinary partners, Ben Rosner and Leo Simon. After Mr. Simon’s death, the business was offered to Diversified for cash in 1967. Ben was to continue running the business - and run it, he has.

在與多元零售公司合併之後,我們取得聯合零售商店100%的股權,這是一家擁有75家女性流行服飾店的公司,聯合公司是在1931年在芝加哥由兩位創辦人Ben Rosner及Leo Simon以3,200美元開立第一家店面,在Simon先生死後,由多元零售公司在1967年以現金買下,並由Ben照原來方式繼續經營這家公司。

Associated’s business has not grown, and it consistently has faced adverse demographic and retailing trends. But Ben’s combination of merchandising, real estate and cost-containment skills has produced an outstanding record of profitability, with returns on capital necessarily employed in the business often in the 20% after-tax area.

雖然聯合商店的業務因為面臨地區以及零售趨勢的困境而停滯不前,但Ben在商品販售、不動產以及成本控制的能力依舊讓公司創造出優異的獲利成績,使得資金運用的報酬率達到20%股東權益稅後報酬率之譜。

Ben is now 75 and, like Gene Abegg, 81, at Illinois National and Louie Vincenti, 73, at Wesco, continues daily to bring an almost passionately proprietary attitude to the business. This group of top managers must appear to an outsider to be an overreaction on our part to an OEO bulletin on age discrimination. While unorthodox, these relationships have been exceptionally rewarding, both financially and personally. It is a real pleasure to work with managers who enjoy coming to work each morning and, once there, instinctively and unerringly think like owners. We are associated with some of the very best.

Ben今年75歲,但與伊利諾國家銀行81歲的Gene Abegg以及Wesco 73歲的Louie Vincenti一樣,每天依舊為所領導的企業灌注無比的熱情與活力,外界不知情的人還以為我們對於這群傑出的經理人有年齡上的特殊偏好,雖然極不尋常,但這樣的關係實在是讓我們受益良多,無論是在財務上或精神上都是如此,與這群「樂在其中」並以像老板一樣心態每天認真經營公司的專業經理人在一起工作實在是一種享受。

Warren E. Buffett, Chairman

March 26, 1979

華倫.巴菲特

董事會主席

1979年3月26日

留言

張貼留言