Warren Buffett's Letters to Berkshire Shareholders 1978

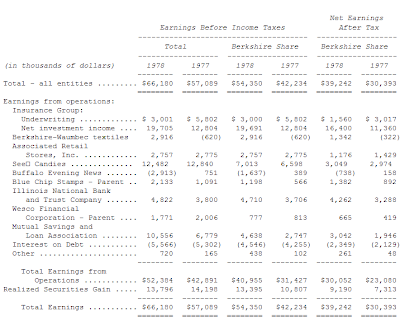

BERKSHIRE HATHAWAY INC. 波克夏海瑟崴股份有限公司 To the Shareholders of Berkshire Hathaway Inc.: 致Berkshire公司全體股東: First, a few words about accounting. The merger with Diversified Retailing Company, Inc. at yearend adds two new complications in the presentation of our financial results. After the merger, our ownership of Blue Chip Stamps increased to approximately 58% and, therefore, the accounts of that company must be fully consolidated in the Balance Sheet and Statement of Earnings presentation of Berkshire. In previous reports, our share of the net earnings only of Blue Chip had been included as a single item on Berkshire’s Statement of Earnings, and there had been a similar one-line inclusion on our Balance Sheet of our share of their net assets. 首先,是會計相關的議題,在年底與多元零售公司的合併後,對於公司的財務報表有兩項影響,首先在合併案完成後,我們對藍籌郵票的持股比例將提高至58%左右,意味著該公司的資產負債以及盈餘數字必須全部納到Berkshire的報表之內,在此之前,我們僅透過權益法按投資比例認列藍籌郵票的淨值與收益。 This full consolidation of sales, expenses, receivables, inventories, debt, etc. produces an agg